In the fiscal landscape of 2022, Nigeria prominently ascended to the status of the world’s most crypto-engaged nation, as evidenced by multiple academic studies. The research indicates that a substantial proportion of Nigeria’s population – exceeding 10% – are active crypto holders. This has positioned Nigeria at an impressive sixth place globally in terms of crypto ownership. An ancillary data source, Google search trends, underscores this fact, demonstrating a profound national curiosity in acquiring and safeguarding cryptocurrency assets.

If you, like many, find yourself intrigued by the idea of crypto investment in Nigeria, or have already ventured into the realm of digital assets, your primary concern likely revolves around their safe storage. The importance of robust security measures for your digital assets, be they cryptocurrency or Non-Fungible Tokens (NFTs), cannot be overstated. Herein, the role of your crypto wallet is of paramount significance, contributing substantially more to the safety of your assets than you might initially imagine.

To navigate this essential topic, we’ll initiate with a clear definition of a cryptocurrency wallet, proceed to elucidate its functioning, and subsequently explore the diverse types of crypto wallets available, concluding with guidance on selecting the most suitable option.

In essence, a cryptocurrency wallet is a tool – either a physical device or software application – innovatively engineered to securely store and transfer your cryptocurrency.

Navigating the complex world of crypto wallets, specifically focusing on Bitcoin and USDT (Tether) wallets in Nigeria, can be quite an endeavor. Here, we will provide you with an insightful guide, reviews, and some recommendations to simplify your decision-making process.

Bitcoin Wallets:

Bitcoin, the first and arguably the most popular cryptocurrency, requires a secure and efficient wallet for storing and transacting. For Nigerian users, here are some top-notch options:

- Cropty Wallet: An all-in-one wallet solution for mobile and desktop users, Cropty supports a vast array of cryptocurrencies, including USDT. It offers robust privacy features and allows for an exchange between different cryptocurrencies within the wallet.

- Luno: A popular choice in Nigeria, Luno offers a secure wallet for Bitcoin and other cryptocurrencies. It’s known for its user-friendly interface, comprehensive security features, and the option to trade directly on its exchange platform.

- Blockchain Wallet: Blockchain.com provides a universally recognized wallet that supports Bitcoin, among other cryptocurrencies. It offers advanced security measures, including two-factor authentication, and allows for seamless transactions.

- Electrum: A desktop wallet suited for more experienced users. Electrum offers advanced features like multi-signature transactions and has a focus on speed and security.

Remember, the safety of your Bitcoin assets relies heavily on how securely you store your wallet’s private keys and recovery phrases.

USDT (Tether) Wallets:

USDT, a stablecoin pegged to the US dollar, offers the stability of a traditional currency while maintaining the benefits of a cryptocurrency. Here are some wallets that support USDT in Nigeria:

- Cropty Wallet: An all-in-one wallet solution for mobile and desktop users, Cropty supports a vast array of cryptocurrencies, including USDT. It offers robust privacy features and allows for an exchange between different cryptocurrencies within the wallet.

- Binance: Besides being one of the world’s largest cryptocurrency exchanges, Binance provides a secure wallet to store and transact USDT. It comes with an integrated trading platform, making it easier for users to trade and convert their assets.

- Trust Wallet: This is a secure and intuitive mobile wallet that supports a multitude of cryptocurrencies, including USDT. Trust Wallet provides a unified wallet address for all supported coins, simplifying the user experience.

Regardless of the wallet you choose, always consider the safety measures, transaction fees, customer support, and ease of use. Regularly update your wallet software to the latest version to ensure maximum security. Also, be wary of phishing attempts and only download wallets from trusted sources.

How Does a Crypto Wallet Work?

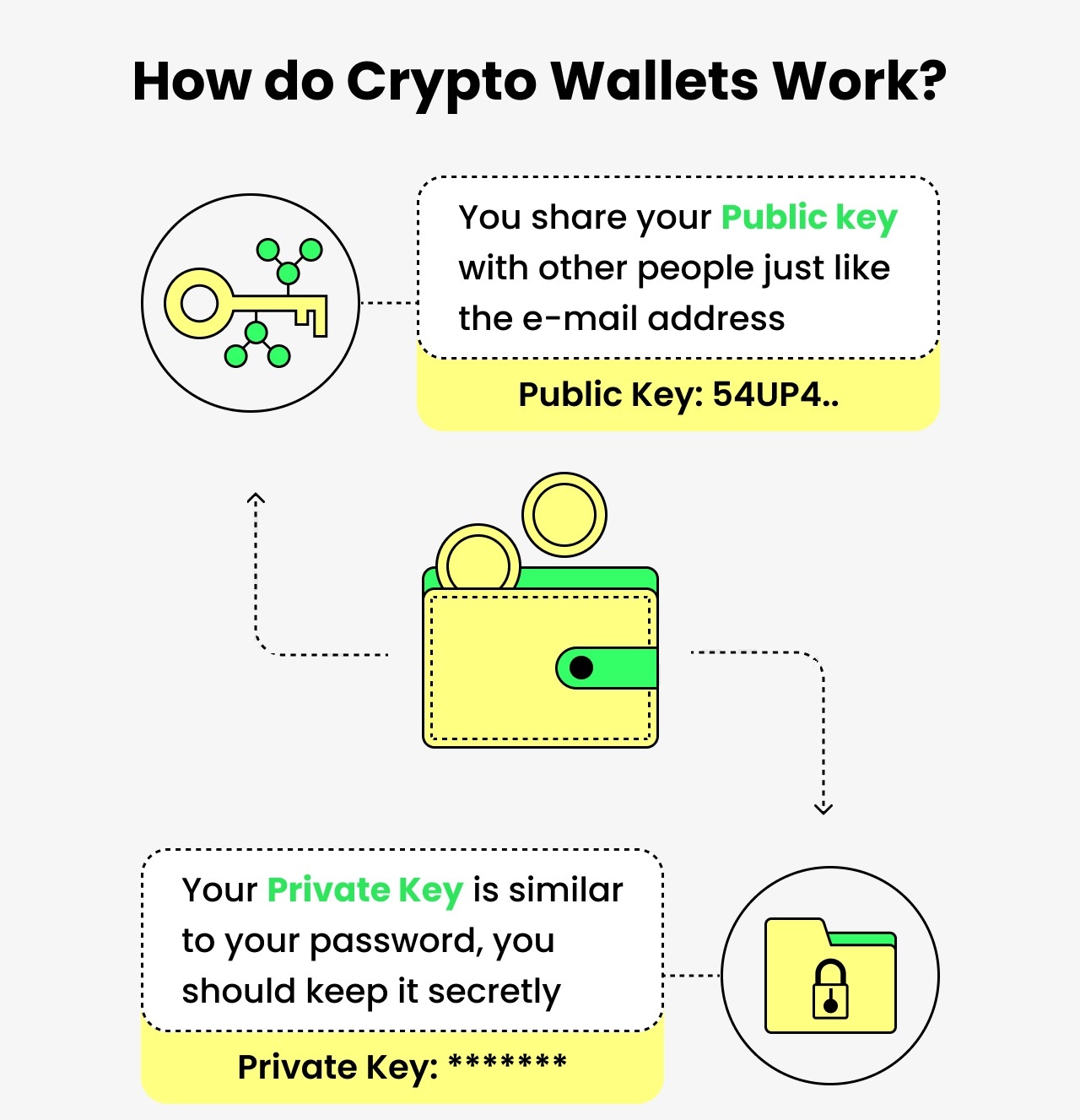

Conceptualizing cryptographic wallets can be significantly simplified if we draw a parallel to a digital safety deposit box that solely you possess access to. These wallets function on a key pair mechanism: a private key and a public key.

To put it simply, a public key operates as your crypto wallet’s address in the digital realm. It comprises a series of alpha-numeric symbols generated through a randomization process. This unique identifier allows other users to transact with you while preserving the integrity of your digital assets.

The private key constitutes the most crucial facet of a cryptographic wallet, and it’s often the area where newcomers encounter challenges. Analogous to a key to a safe deposit box, the private key wields the power to govern the wallet’s balance. In the hands of an unauthorized individual, it can lead to a complete loss of your digital assets.

This private key is not merely a protective measure, but also an initiator of transactions, a process known as “signing”. Consequently, the inclusion of a private key is fundamental across all wallet forms, be it hardware or software-based.

One of the paramount benefits of either mode of cryptocurrency self-storage is the fortification of your assets by private key cryptography. This technology mirrors that which secures your credit card information during online transactions, underscoring its robustness.

Cryptocurrency Wallet Types

To effectively navigate the crypto sphere, it’s essential to comprehend the classification of crypto wallets. This understanding will help delineate between the diverse functionalities of different wallet types.

Crypto wallets can be categorized based on the device they operate on, as follows:

Web or mobile wallets strike an optimal balance of convenience and functionality. These wallets offer the advantage of accessing your digital assets from any device with an internet connection, eliminating the need for software installations. Examples of web wallets pertinent to the Nigerian context include Coinbase and Cropty.

Desktop wallets, while less convenient than their web-based counterparts, offer a higher degree of security. They necessitate downloading and installing software on your personal computer, providing you with more control over your private keys. Renowned examples of desktop wallets include Electrum and Exodus.

Hardware wallets, however, are widely recognized as the most secure type of wallet for Nigeria, and indeed, for any country. They store your private keys offline on a physical device, which makes them immune to potential hacker attacks or malware infections. Their downsides include potentially high costs and a degree of inconvenience, as the hardware device must be physically present for access. Trezor and the Ledger Nano S exemplify hardware wallets.

Paper wallets are another extremely safe storage option. They’re immune to hacking and malware as they merely constitute a physical printout of your public and private keys. The risk factors associated with paper wallets include potential loss or theft and a general lack of convenience in usage.

Custodial and Non-Custodial Crypto Wallets

The ongoing discourse around cryptocurrencies in Nigeria frequently revolves around topics like decentralization, cryptography, proof-of-work, and so on. Yet, the crux of the cryptocurrency concept lies in the principle of “complete ownership of your asset”. To illustrate this, consider the traditional economy where banks act as intermediaries performing numerous functions with your funds. These functions include transaction validation, account freezing, and private financial data storage, a concept known in the crypto realm as custody.

In stark contrast, the blockchain ecosystem empowers individuals to handle these interactions themselves, based on a set of established rules. Essentially, you can act as your own bank, conducting financial operations like staking, lending, transferring, and storing your assets without any intermediaries. This implies that you can store your cryptocurrency directly on the blockchain, accessible via a private key, bypassing third-party entities like banks or financial institutions.

Hence, crypto wallets can be categorized into two primary types: custodial and non-custodial.

Custodial services, such as those offered by many cryptocurrency exchanges, store the public and private keys on the company’s servers. The onus of data backup falls on the service provider in this scenario. Cryptocurrency exchange wallets and certain software wallets exemplify this category.

Non-custodial wallets, on the other hand, allow users to store keys on their personal devices. Upon account creation with these wallets, the user is prompted to input a recovery phrase. This ensures that access to the cryptocurrency remains possible even in the event of key loss. These wallets primarily function on open-source code, truly embodying the ethos of decentralization while allowing you to maintain the privacy of your private keys.

The debate regarding the security of centralized custodial services versus personal custody is ongoing. While some argue that self-custody carries a lower risk, it does bring with it the potential hazard of losing your private key. Unlike with custodial services, there is no support helpline you can turn to for restoring access to your wallet in such a scenario. Keep these factors in mind when choosing your crypto wallet provider.

Key Features for Wallets

Numerous features are worth considering when selecting a crypto wallet, but security undeniably sits at the forefront. The wallet will be entrusted with your hard-earned funds, necessitating the utmost assurance of its safety. Here are several critical characteristics to look for in a secure crypto wallet:

- User-friendliness: A high-quality wallet should sport an intuitive interface, easy to navigate even for newcomers.

- Feature-rich: It should offer a myriad of functions, including sending and receiving payments, storing multiple currencies, and tracking transaction history.

- Security: Essential security features such as two-factor authentication and backup options should be standard to bolster the protection of your funds.

- Compatibility: Finally, the wallet should be compatible with your devices and operating systems for seamless operation.

With Crypto-Wallet.ng, you are poised to discover the optimal crypto wallet, not only in Nigeria but also on a global scale!